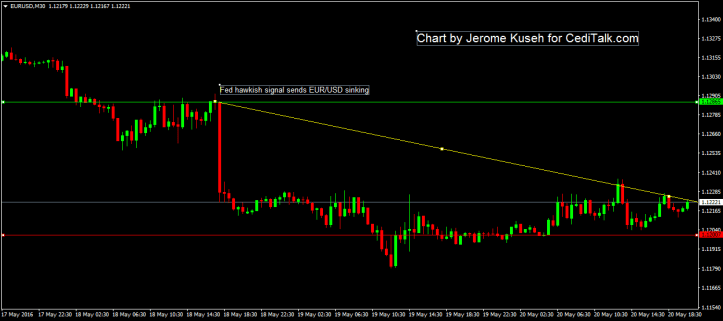

The chart below is my attempt at technical analysis for the past week and looking forward to my trading next week.

Look at the point at which it becomes known that the Federal Reserve is considering raising interest rates in June. We see the EUR/USD collapse from 1.1287 and not recover to close at 1.1222 for the week.

This is a demonstration of what can immediately happen to small capital traders like myself during economic events. It’s also an example of why not to use too much leverage. Now I exited my position a day before the announcement. Assuming I had stayed with my bearish outlook I could have reaped much more than I did. But if I was wrong I was going to lose quite a bit in just a short while with little chance of recovery because I’m not trading long term.

Now the support line I have drawn is at 1.12 and I have drawn a resistance of 1.128. I am more confident that the EUR/USD will break support than resistance in the coming week because I’m bearish but I am not going to wager on it falling far below support because this chart is supposed to keep me disciplined. However if the price does rise far above support best believe I’m shorting. That depends however on whatever new information comes out during the week because I’m a fundamentals guy first and foremost. And my technical analysis sucks.

Happy trading.

PS: Trading is very risky. Read my disclaimer.