The Monetary Policy Committee of the Bank of Ghana will be meeting on March 18 to review economic developments in the country and announce a decision on the policy rate on March 21.

The policy rate is currently 26%. The MPC maintained it at their last press conference on January 25.

The inflation rate for January 2016 was 19%, a sharp jump from the 17.7% recorded in December 2015. This is even further from the 8+/-2% inflation target band of the BoG which looks more unrealistic by the day.

However the BoG should be prepared to maintain the policy rate subject to the inflation rate that will be reported for February. The increase in inflation seems to be due to supply-side occurrences such as the imposition of higher import tariffs and utility charges. A hike would be unlikely to tackle that. Also a rate hike is likely to worsen business confidence which is already on the decline.

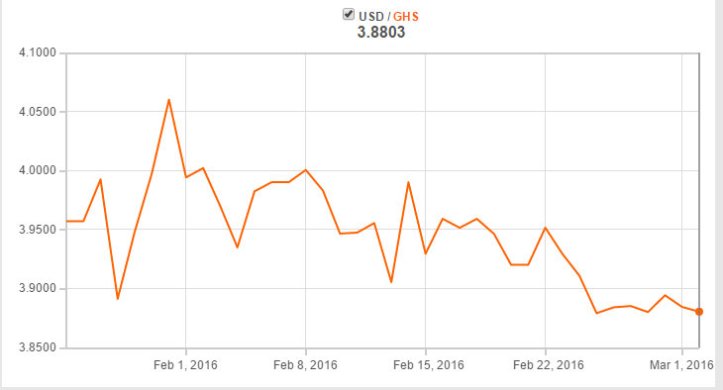

Despite higher inflation, the cedi has strengthened against the US dollar since the last MPC release as shown below.

The stronger cedi gives the government more fiscal space as the dollar-denominated interest payments reduce.

Another interesting development is the reduction in treasury bill rates (91 days) to 22.6069% from 22.6787%. It is interesting that even with higher inflation, the government is able to borrow at a lower interest rate. This could mean that there’s a lack of alternative investments in the market and is more reason why the BoG should not hike the policy rate.

Of course, the inflation rate for February may change everything. I’m looking forward to its announcement.